Maturing Tech Companies

In the last 20 years, there have been four particular tech companies that have gone public and stood out in terms of growth: Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Google (GOOG) referred to as FANG by Jim Crammer. I love these companies; they have been my bread and butter, but at current valuations and PE ratios, I can never feel good about buying more shares. For now, these companies will continue to rise in value so long as they hit their growth metrics but mark my words: these companies do have a cap on their growth.

In particular, Facebook and Google’s main streams of revenue, digital ads, are capping out. It has been reported that the number of ads Facebook can place in its news feed is starting to get to the point that they are becoming destructive and, on average, 1 in 7 posts on the news feed is an ad. No one wants to see ads in their feed, and more ads in the news feed will turn Facebook into “Ad Feed” turning off daily active users (DAU), which is a key growth metric the market likes to see an increase.

As for Google, it is being reported that they are selling more ads, but the price of the ads is decreasing. If this pattern continues, their main source of revenue will eventually decrease. Taking a look at Netflix, the metric investors like to see a growth in new subscribers. Somehow, for now, Netflix is still gaining subscribers in the US, but that metric will get harder and harder to grow and, eventually, the party will end. Netflix has been proactive about this and has been pushing for international growth.

This is good, but it must be noted that this is an extremely difficult and expensive thing to do. Amazon, I believe, has it better than the rest of the companies in FANG because they have a diverse portfolio of sectors they are in or entering, but I can assure you that, eventually, investors are going to want to see them mature as a company and become more profitable.

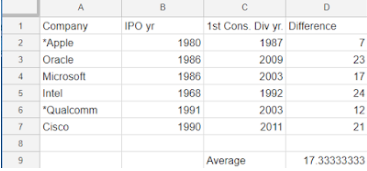

In becoming a mature tech company, a company must eventually be able to pay a dividend. I took the average of the years between the initial public offer (IPO) date of mature tech companies and the first full year of consecutive dividends paid out to shareholders on the chart above. The companies included are Apple, Oracle, Microsoft, Intel, Qualcomm, and Cisco. We can clearly see the average is just about 17 years, but It’s important to note that Apple’s dividend came to a halt after 8 years because their Apple II became outdated; in addition, the Jobs drama went down, as we all know, from the countless Steve Jobs movies and documentaries.

Going with our 17-year average, our FANG stocks are fast approaching the average. It has been five years since Facebook’s IPO, giving it plenty of time to go through another market correction and mature. Next up, the tech darling, Amazon, IPOing 20 years ago. Yikes! Netflix is fast approaching with its IPO 15 years ago, and Google’s IPO was 13 years ago giving them a solid five years. Out of our four companies, only one is past the 17-year average, but I’d like to think that Amazon still has the most fuel left in their “growth rocket”, so I’m going to write them a hall pass.

In my opinion, Netflix has the least amount of fuel left in their rocket because of their ‘low fuel efficiency’ of expanding internationally and their limited potential of American subscriber growth. My prediction is that their company will continue to grow after the next market correction. However, I would place a bet on Netflix’s share price not growing nearly as fast for years afterward unless they make some significant strategic business moves to grow their bottom line.

Lastly, we have Google. Google could already pay out a hefty dividend to shareholders if they cut funding for Google X and Google Ventures, and increase engineer productivity. Instead, Google is continuing to go with the Amazon approach and diversifying their portfolio to drive growth. This is fine, but shareholders are going to want to eventually see value out of assets such as Waymo. My prediction is that, after the next market correction, Google will start paying out a dividend in the next few years.

DISCLAIMER: Cameron is not a certified financial advisor and all things stated should be considered solely as entertainment and NOT for financial transactions.

Cameron Blackwell is a sophomore in his first year of Publications. He is excited to see his interest journalism evolve in the Publications class. Outside...

Mary Suran • May 11, 2018 at 1:58 pm

Keep up the good work. Enjoy your column.

Cameron Blackwell • May 12, 2018 at 11:00 am

Thank you Ms. Suran!